A budget is a critical piece of any successful financial picture. Without a budget, it is hard to know where you stand financially. Even if you have a healthy emergency fund, a budget will allow you to track how much money you are earning, saving, and investing every single month.

Table of contents

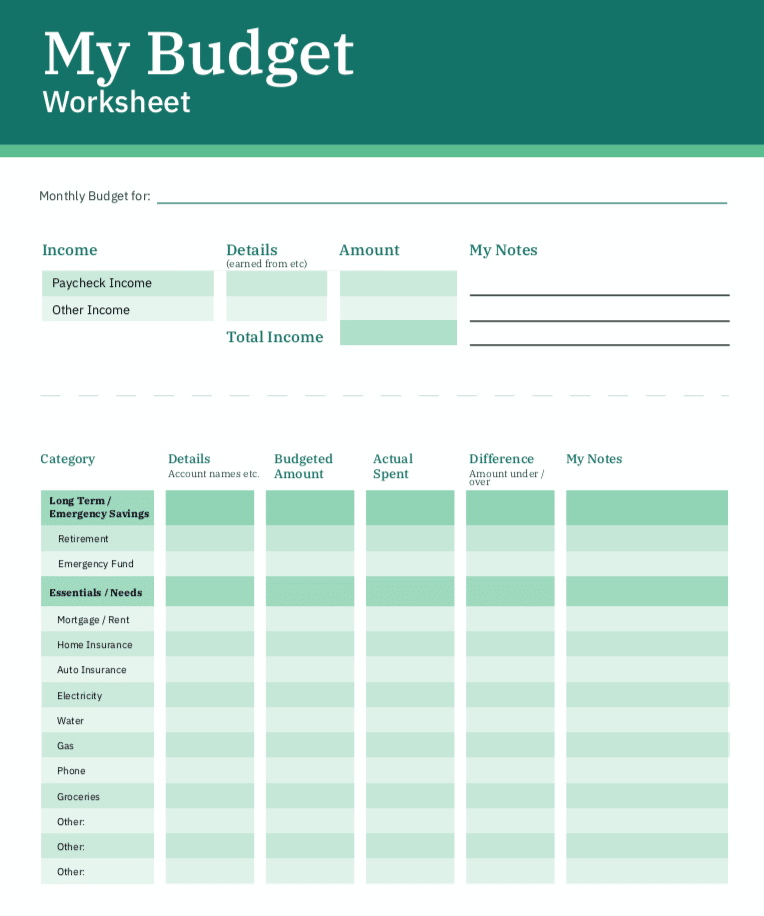

You’ll need a budget tracking template to help you manage the details of your budget. It would be physically impossible to remember every single detail of your budget.

Without a helpful spreadsheet to hold all of the important information, you might find that you are missing out on crucial details.

Luckily, there are many great budgeting tools available. We will cover the best budget templates and apps.

What is a budget template?

A budget template will help you manage your budget by tracking all of the minor details. You’ll be able to customize the spreadsheet to meet your budget specifications. For example, if you budget biweekly.

On a monthly basis, it can let you know how much you have left to spend. You’ll be able to stay on budget without constantly running through your checking account transactions.

I’ve found that it allows me to track patterns in my spending. Additionally, I’ve noticed that some times of the year are more expensive than others. With that information, I’ve been able to better plan for my future, so templates for budgeting are extremely important.

10 Best budget templates and apps

So, what are the best budget templates? Let’s take a closer look at my favorite options.

1. Clever Girl Finance Free Budget Template

Clever Girl Finance offers free budget templates in both printable and spreadsheet versions, that can help you set up a budget and track it over time. The comprehensive worksheets will walk you through each category in your budget.

First, you’ll work through setting up your spending goals for the budget categories. You’ll need to think of a wide variety of categories from debts to groceries and everything in between.

You’ll have the space to track your income from multiple income streams. Plus take notes about your spending patterns over time. If you see something that you’d like to change in your budget, then you can adjust for the next month.

The worksheets have several questions that will force you to think about potential ways to cut back on your expenses or increase your income.

Click here to download this free budget tracking template (and more)! From there, you can start working on building your budget today!

Be sure to pick up a copy of the book, Clever Girl Finance: Ditch Debt, Save Money, and Build Real Wealth and the rest of the Clever Girl Finance book series!

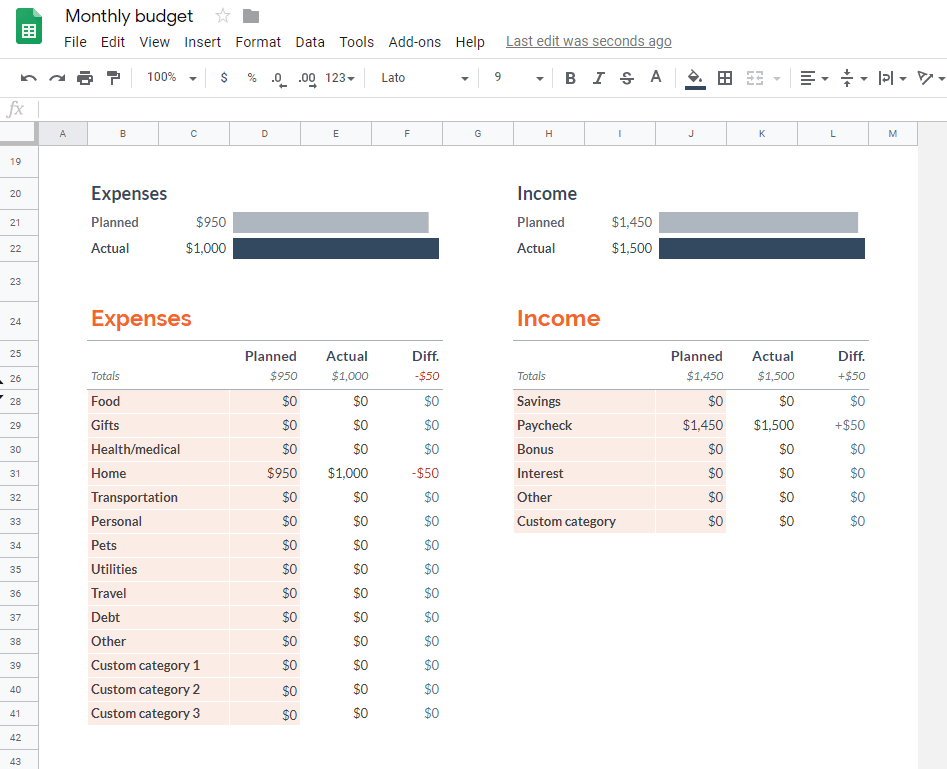

2. Google Sheets Budgeting Templates

You may have wondered, “Does Google Sheets have a budget template?” Yes, Google Sheets does have free budget templates that you can use for money management.

If you are a very data-inclined person, then using a Google Sheet budget template could be a good solution. You will need to enter all of your spending data by hand.

That might involve saving receipts each month or checking through your bank statements if you mostly spend with a plastic card.

Overall, using a Google Sheet budget template is not a very visual way to track your budgeting progress. However, the numbers don’t lie. You will be able to see what you are spending and make plans to adjust that spending.

Although entering the data can be time-consuming, it can help you truly understand your spending patterns. You’ll be forced to relive every purchase as you enter them into your budget spreadsheet.

You can find the official Google Sheets Budget template here. It is fairly basic, but it does allow you to track your spending each month.

If you are interested in using this sheet, you’ll need to make a copy of the sheet after requesting access to the sheet. After making a copy, you’ll be able to make edits and track your budget in your own account.

So does Google sheets have a budget template, yes, but if you don’t like the free budgeting templates, then you can customize your own Google Sheets file.

3. Microsoft Excel Budget Template

Excel offers budgeting templates that are very similar to Google Sheets. However, you might need to pay for them. If you don’t already have Microsoft 365, then Excel will require you to pay for their budgeting templates.

Like Google Sheets, the template requires you to fill in the data in a hands-on way. It might take some time to get used to the format. But it can be a good way to think through where your money is going each month.

If you want to use Excel but don’t want to pay for its premium version, then consider building your own spreadsheet. Personally, I use an Excel sheet that I built myself to track our budget.

Each month I write down our purchases and determine how much we’ve gone over or under budget for the month. It can be a great free option if you are handy with Excel.

4. Personal Capital (App)

Personal Capital can help you track your long-term financial goals. Where Personal Capital shines is as a net worth tracker.

Although it does offer some budgeting assistance, the platform is focused on your net worth. The goal is to help track and manage your investments over time.

If you choose to use Personal Capital, then it might be useful as a general budgeting helper. It can show you how much your savings have grown each month. That will give you an idea of whether or not you stuck to your budgeting goals.

5. Credit Karma’s money management tool

Credit Karma offers you the opportunity to check your credit score on the go. And the best part is that it is completely free!

The website features resources like a mobile app, loan and credit card information, and more.

6. You Need A Budget (App)

The mission of You Need A Budget, or YNAB is to give every single dollar a job. The budget you create will have you allocate every last dollar to a category. You’ll be able to choose different budget categories including savings for each and every one of your dollars.

The YNAB app takes the difficult parts out of budgeting. In fact, it is one of the best budgeting apps available.

The software will track all of your spending so that you don’t have to add it to a spreadsheet. Instead, you’ll be able to send and receive updates from your YNAB app about your budget.

If you are starting from scratch and prefer a mobile method, then YNAB is a great solution to help you develop a budget. You can try it for free for 34 days. After that, you’ll pay a small monthly fee for the service.

7. EveryDollar (App)

EveryDollar is another monthly budgeting app that can help you stay on track. You’ll be able to build your first budget in less than 10 minutes and track it throughout the month.

I’ve noticed the format of the app is extremely simple, but it will get the job done. Although there are no bells and whistles, I still think the app can help you manage your budget effectively.

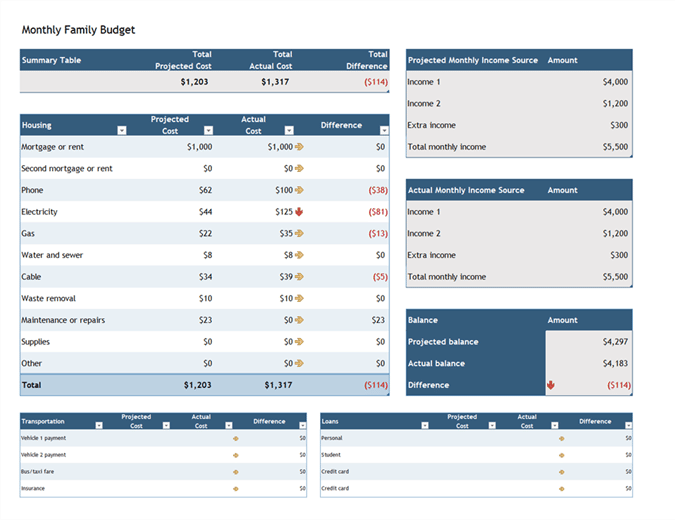

8. Vertex42 budget spreadsheets

The Vertex42 website offers multiple spreadsheets to help you with your finances, including personal budgeting templates, a monthly budget sheet, and more.

The personal budget spreadsheet is available to download in Excel or google sheets. It includes categories like health insurance, car payment, and charity.

So you can keep track of your entire family budget and home expenses all in one place. The website offers some of the best budget templates out there.

9. Pocket Guard (App)

The Pocket Guard app is known for helping people to keep their spending in check. It keeps track of spending in list and pie chart form.

In addition, this budgeting tool offers different categories for budgeting and allows you to see how much money you still have after paying your bills.

10. Simplifi by Quicken (App)

The Simplifi app is trusted by many like Forbes and USA Today. The app gives you a place to track your savings goals, as well as a way to see your spending over the course of several months.

It’s the easiest way to stay on top of your finances, and you can try it for free, though there’s a monthly fee after 30 days.

It gives a great overview of spending and it will even send you alerts on your phone for your money. In addition, it offers insights into your investments by keeping everything organized in one place. See your expense categories, in addition to actual costs, and learn to track expenses in a simple way.

Expert tip: Find a budget template that works for you

Leveraging a budgeting template or all can greatly simplify your approach to budget. It can also save you a significant amount of time. The key is to find a template that fits into your lifestyle. I recommend testing out a few different templates to determine which format would be the best fit for you.

Should you use a budget template or app?

Now you’ve gone from wondering “Does Google Sheets have a budget template?” to understanding your various options for spreadsheets from Excel and Vertex42, and the ever-popular money apps.

Yes, you should absolutely use a budgeting template or app to manage your money. Unless you already have your budget under control, a budget tracking template is essential for learning your spending habits and becoming great at money management.

Whether you prefer the best budget templates as a spreadsheet or app, you’ll be able to better visualize where your money is going.

That can lead to more intentionality with your money. And while there are paid options, you can also find free budget templates to avoid overspending.

Is there an Excel template for budgeting?

Yes, Excel offers several templates for budgets that you can customize for your needs. You can get Excel budget templates for free directly from Microsoft.

The platform Vertex also offers some great free Excel budget templates.

If you are looking for something more in-depth, you can purchase templates by doing a quick search on platforms like Etsy.

Related posts on budgeting

If you have enjoyed this article on best budget templates, check out our related content:

Leverage these templates for budgeting to manage your money better!

A budgeting spreadsheet or app is a great place to start managing your budget. And having access to the best budget templates can help you get your finances to a better place. However, it might not be enough to help you build a budget that works for you.

If you need more help designing a budget that works for you, then consider taking our completely free budgeting course! You’ll learn about the different budgeting methods and choose the best option for your lifestyle.

Move forward with these templates for budgeting today. You absolutely will not regret it!