Learning how to make a money vision board can be incredibly helpful for financial management. When it comes to goals, the adage rings true: “Out of sight, out of mind.” But if you take the time to create a vision board, you’ll constantly be reminded of your goals.

Table of contents

- What is a vision board?

- Why is a money vision board a good idea?

- Using a vision board to achieve your money goals

- Expert tip: Keep a positive money mindset

- How do you format a vision board?

- What questions should you ask yourself when creating a financial vision board?

- Articles related to having a plan for your money

- Knowing how to create a money vision board can help you improve your finances!

As cited in Verywell Mind, vision boards can improve success and mindfulness. For this reason, creating one can help us stay focused on working toward our financial goals.

What is a vision board?

A vision board is a collage of pictures and phrases that depict things you want to accomplish in your future. It’s a visual representation of your hopes and dreams. Its purpose is to serve as inspiration and motivation for working toward your goals.

Being able to see exactly what you want to accomplish gives you something to work toward, rather than just letters on a page. After all, even though there’s still value in writing your money goals down, seeing is believing!

I personally create a money specific vision board every year to keep me focused on the money goals I want to accomplish.

Why is a money vision board a good idea?

If we think about it, most goals are connected to our finances in some way. Our dream house, car, and vacation will require money. Having a money vision board can help us stay focused on attaining those things.

A money vision board is a great idea because it’s designed to visualize your intentions for money. Whether it’s how to save money, paying off credit card debt fast, or increasing your income, your ideas can be put into visual form.

Financial vision boards often utilize charts (such as a savings goal thermometer) to track progress. So if your vision is to become debt-free, you may include a debt payoff tracker on your financial vision board.

When it comes to saving money, I love coloring in my savings thermometer as I cross each savings milestone that I’ve set for myself. Just seeing this visualize reminds me of the progress I’m making.

Using a vision board to achieve your money goals

Using a vision board for your financial goals is no different from any other goal. The whole point is to create a physical representation of what you want to accomplish. If you’ve had a hard time handling money in the past, perhaps this fun exercise will help keep you motivated.

Plus, building a board for your money can easily be integrated into your financial planning process. As you develop a plan, simply create a board to go with it.

For example, you can think of it as the final seal on your list of money intentions. Here are some steps that I personally use and find helpful. You can leverage them to bring your vision board ideas to life:

1. Decide on a physical or digital vision board

There are several different ways to make a vision board.

For example, you can go the old-school route by cutting out words and images from old magazines, this is my format of choice. Or you can make a digital one using an online graphics tool, like Canva. Both options are free and/or very affordable, so it just depends on your personal preference.

Here’s what you’ll need to create a physical vision board:

- Poster board or cork board: Though most vision boards are pictures glued to a poster board, you can also use a cork board and tack images instead.

- Old magazines: You’ll use magazines to find pictures, phrases, and other visual inspirations that represent your goals. They’ll need to be old because you’ll be cutting things out. You may be able to grab old editions of magazines from your local library or convenience store for free or at a reduced price.

- Your affirmations or inspiring quotes: These are words, phrases, and sentences that inspire, motivate, and help you focus on what you can achieve.

- Images from online: If you can’t find old magazines, you can always find inspiration online. You can print out images that you find suitable.

- Glue or tacks: You’ll need to glue or tack your pictures to your poster or corkboard. I recommend a glue stick if you’re using glue.

- Scissors: You will cut out images to add to your board, so have a pair of scissors handy.

Here’s what you’ll need to create a digital vision board:

- Powerpoint, Keynote, your Notes app, or a graphics app like Canva

- Digital images

- Affirmations or inspiring quotes

2. Write down your financial intentions before you start

Your intentions will be your foundation. So, the second step in figuring out how to make a vision board is to write down your goals.

These goals should be very clear so that you know exactly what you’re trying to accomplish and how you’ll accomplish it. One way to do this is by using the SMART goals method.

This goal-development method teaches you to create specific, measurable, attainable, realistic, and timely goals. When you have SMART goals, you can easily see what you’re working toward.

For example, my financial goal may be to “save $10,000 for emergencies by Dec 31, 202X.” This goal is very specific; its success can be measured; it is realistic for me, and it has a timeframe.

Since this goal has a very clear description, finding a suitable visual representation will be easy.

No matter what your financial objectives are, it’s important to clearly define them and write them down on paper before you start getting creative and building your money vision board.

3. Consider including charts and graphs

Whether creating a digital or a physical vision board, you want to choose pictures and words that motivate and inspire you.

But don’t forget about numbers! Including charts and graphs alongside the visual elements on your vision board can help make it even more specific to your goals.

Now, when you’re putting together a financial vision board, you may also include money savings charts. Money savings charts are charts that help you with tracking savings for specific goals.

For instance, if one of your intentions is to pay off debt, you could include a debt payoff coloring chart that tracks your progress. Every time you make a payment, mark it on your debt payoff chart—and watch your vision board become your reality!

These charts come is several different styles and formats. You can even design your own. My favorite money chart is the thermometer format.

4. Place your vision board somewhere you can see it every day

The point of creating a vision board is to have visual inspiration for the goals that we’re trying to accomplish.

That said, your board needs to be in your vision literally. In other words, you have to put it somewhere you’ll see it every day!

So think: What place do you most frequent in your home? That’s exactly where your vision board should be.

Put your board in a place where you can see it every day. That way, it’ll serve as a daily reminder to continue working toward your vision.

Consider places like your bedroom, office, or even your refrigerator door. You can even take a photo and make it the screensaver on your mobile phone or computer desktop. I have mine as my phone screensaver and also in my home office.

Additionally, now that you’ve created your vision board, take a moment to review it. Is there anything that you want to add? Do you feel motivated?

If you haven’t already, add phrases and money affirmations that align with your goals.

5. Stay motivated by hosting a vision board party

We all know that there’s a lot of temptation to spend and, thus, a lot of temptation to stray from our money intentions.

So, to help yourself stay motivated and on track, consider hosting a party.

Gather friends together who are also focused on improving their personal finances. You can spend the day together outlining your goals, cutting out pictures, and creating your vision boards. Then, you can check in with each other monthly to follow up on your progress.

Believe it or not, this sense of accountability can go a long way in helping you achieve your goals. As Forbes explains, “…accountability groups can positively impact task performance and academic performance.”

6. Track your progress with a money journal

Creating a board for money goals is a great way to get inspired and energized to start working towards your long-term financial goals. But over time, it’s easy to lose some of this initial momentum.

One way to help yourself stay on track with your personal finances is to start a money journaling habit.

Money journaling is more than just writing down what you spend and save each month. It’s also a place to take notes on how you feel about your spending and saving, your thoughts on your finances, and your observations on your goal-tracking.

Don’t think journaling is worth the extra step? One study discovered that those who write their goals are 42% more likely to actually accomplish them.

7. Edit as you go

Another way to track your progress toward your financial goals is to edit your money vision board.

We already talked about adding money savings charts. But if you’re not a facts-and-figures person, there’s still another way you can track your progress visually on your board.

For example, suppose you’ve added three goals: 1) Pay off credit card debt; 2) Start emergency fund; 3) Open retirement account.

Every time you meet a goal, you can draw a big green checkmark next to it. For one, drawing this checkmark will probably feel satisfying. (You know that feeling of crossing an item off your to-do list?)

Plus, it’ll be another visual reminder that you are making progress on your goals—which will give you more motivation to keep going.

8. Consider creating multiple vision boards

If you have a lot of different financial goals, making more than one vision board may make sense.

Here are a few different ideas:

For example, suppose one of your goals is to save up for a down payment to become a first time homebuyer. That could be the subject of one board, where you’ll include pictures of your dream house and inspiring quotes about homeownership.

At the same time, you might have another financial goal to spend less each month by adopting minimalism. On this vision board, you can focus on minimalism.

Write down minimalist quotes to remind yourself that less is more, and you don’t need to buy that new dress this month. You can also include a chart where you list all the things you wanted to buy but didn’t to congratulate yourself on your willpower—and keep up the good work!

Vision board ideas

If you are still stumped on what to include in your vision board, you can always find inspiration on sites like Pinterest. Doing a quick Google search will also lend some examples as well. Remember that your vision board is unique to you, so only use them as inspiration.

Travel example

Here is an example of a financial vision board I created several years ago. At the time I was on my debt-free journey. I also wanted to save money, overcome budget challenges, and budget effectively so that I could travel the world.

As you can see, I included phrases like “saving money,” “debt-free,” and “budget” on my money vision board as a reminder of what I was working toward. I also included flags and cutouts of different countries I wanted to visit once debt-free.

If you have a keen eye, you’ll notice that debt-free is crossed out and that there’s a checkmark beside the word budget. There’s also a year under the flag for the United Kingdom. That is because I was able to actually accomplish these things!

After getting on a budget, I could pay off debt, save money, and travel abroad. There are still several flags and countries that don’t have a year below them, which means it’s still something that I’m working toward.

Though this board is several years old, I still keep it nearby as a reminder of the things that I still want to accomplish financially.

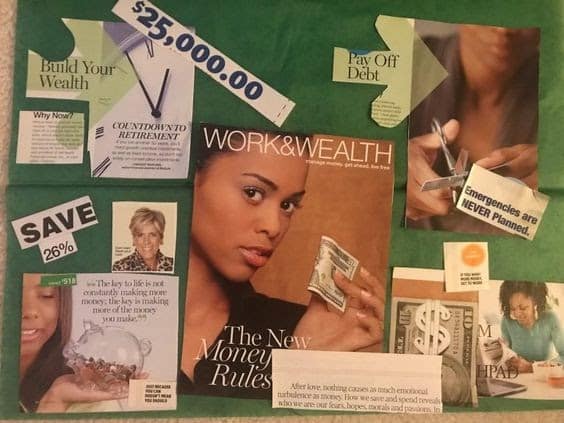

Debt-free & savings example

If your goal is to become debt-free, here is a debt-free vision board example. As you can see, this board includes images of someone cutting up a credit card and a savings goal of 26%. This is a very vivid representation of their financial goals.

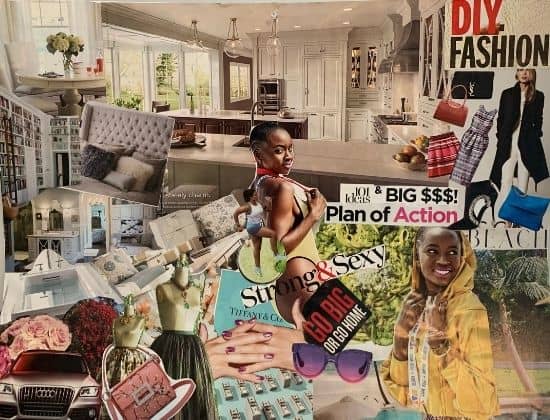

First home example

Need some inspiration for buying a house for the first time or even your dream house? Here’s my latest board that includes images of home elements I plan to have.

The board also includes images and a phrase related to money. That’s because I’ll need to have money saved and a plan of action to achieve this new financial goal.

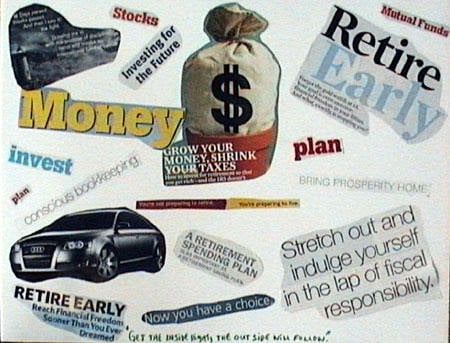

Investing & early retirement example

Are you interested in retiring early? Check out this simple vision board.

Investing and retiring early often go hand in hand. That’s because if you can invest strategically, you can withdraw from your investments to retire early. Learn more about what it means to achieve early retirement.

As a reminder, these examples are all meant to inspire you. Find what motivates and inspires you when creating your board.

Expert tip: Keep a positive money mindset

It’s clear that building a vision board can play a big part in helping motivate us to work towards our money goals. But don’t forget to approach it with the right financial mindset.

After all, learning how to create a mindset of financial abundance can help you realize your dreams.

Whether you want to save a certain amount of money, retire early, buy a house, etc., a mindset of financial abundance helps you remember that the goals on your vision board are achievable—and that with the right planning and action, you can make them come true.

How do you format a vision board?

There are several different ways to format a vision board, but the first step is to always clearly define and set your short and long-term goals.

You can do this digitally, with a Word document, a spreadsheet, or just your Notes app. Or you can go old-school and just start writing on a blank piece of paper with a pen. You can even get creative and color-code your money intentions with a marker.

After you know what your goals are, find images and words that align with them, and add them creatively to your board. It’s all about creating something that’s to your liking visually so that when you look at it you feel inspired and motivated. So tap into your inner artist!

You can also find great vision board photos and examples on sites like Pinterest or watch YouTube videos on how you can create a vision board.

What questions should you ask yourself when creating a financial vision board?

Creating a financial vision board isn’t just about cutting out pictures of things you want to buy. Instead, you need to take the time to sit down and really assess your personal finances and your goals.

You can ask yourself questions as they related to your financial goals. For example, ask yourself:

- Do I have debt I want to pay off? How quickly do I want to pay it off?

- Do I want to build an emergency fund? How much do I need to save?

- I want to save for my children’s college education with a 529 plan; What would that cost?

- Am I saving enough for retirement? How do I bridge any gaps?

- How do I adjust my retirement strategies to retire at 50 instead of 65?

- What does my dream home look like? What views do I want to see from the windows?

Questions like these can help you get clear on what you should place on your vision board.

Articles related to having a plan for your money

If you know that having a vision board will help you with your money, these other posts will also inspire you!

- Changing Your Perception Of Money

- Motivation For Saving Money: 12 Top Tips!

- 10 Money-Savings Charts To Save More Money

- Examples Of Financial Goals

Knowing how to create a money vision board can help you improve your finances!

Money vision boards are an extremely valuable tool for helping you reach your financial goals. They’re also a fun exercise, and you can get as creative as you want when making your own.

The truth is that merely writing your goals down and visualizing them won’t automatically help you achieve them. You must also do the necessary (sometimes hard!) work and hold yourself accountable.

The best way to do that is to surround yourself with others working toward similar goals. You can even get an accountability partner to work alongside side you.

If a community is what you’re missing on your financial journey, then check out the Clever Girl Finance courses and community. Here, you’ll find the resources and accountability you need to be successful with your money.